PMEGP Loan: The Indian government is offering a PMEGP Loan to individuals interested in starting a new business. The Prime Minister’s Employment Generation Program (PMEGP) provides a government-funded, risk-free scheme for small businesses, including rural areas. Applicants can apply for a maximum of 50 lakh rupees, depending on their business category. The eligibility criteria, important documents, and application procedure can be found on the PMEGP Loan website.

The Ministry of Micro Small and Medium Enterprises in India has launched the PMEGP Loan 2024, offering business loans up to 50 lakh to eligible individuals. The loan offers a 15% to 35% subsidy based on the applicant’s category, with repayment options ranging from 3 to 7 years. Eligible beneficiaries can apply online.

Table of Contents

Benefits of PMEGP Loan

- The bank-financed subsidy program aims to support the establishment of new microenterprises in the non-farm sector.

- The margin money subsidy on bank loans ranges from 15% to 35% for projects up to Rs. 50 Lakh in manufacturing and Rs. 20 Lakh in the service sector.

- Special categories like SC/ST/Women/PH/Minorities/Ex-Servicemen/NER receive a margin money subsidy of 35% in rural areas and 25% in urban areas.

PMEGP Loan Eligibility Criteria

- Eligibility is open to individuals over 18 years old.

- The PMEGP will not impose an income ceiling on assistance for project setup.

- No educational qualification is required for applying for a maximum 10 lakh rupees loan for manufacturing units and 5 lakh rupees for service sector units, but applicants with a minimum education qualification of 8 passed must apply.

- If your unit is already registered with a Central or state government subsidy scheme for businesses like PMRY or REGP, you cannot apply.

- Candidates from SC/ST, women, PH, ex-servicemen, and reserve categories will receive a maximum of 35% subsidy in rural areas and 25% in urban areas.

PMEGP Loan Documents

The applicant must provide the required documents and the time of Loan application on the official website.

- Passport-size photograph of the applicant

- The PAN card of the applicant

- Educational certificate ( if required)

- Authorization letter from an authorized institution

- Domicile of the state

- Details of the project

- Category certificate

- Skill development certificate related to your business

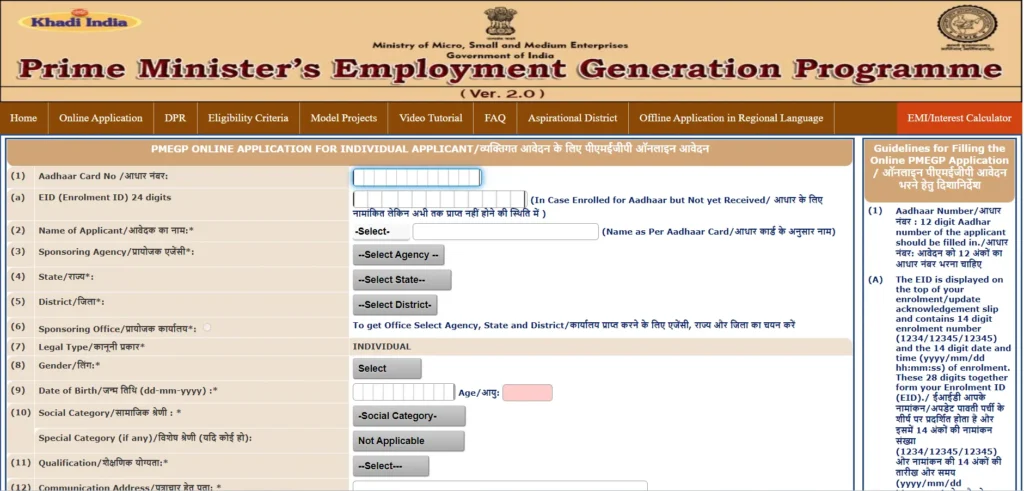

PMEGP Loan Apply

- The application process can be submitted online using the following method:

- Visit the official website of PMEGP of KVIC by clicking on the provided link.

- You will be directed to the dashboard where you need to click on the link for the PMEGP Loan application for a new business.

- Now you will appear on the PMEGP Loan online application form where you have to provide all the required Details.

- To proceed, upload all documents on the official website and click on the submit link.